Detailed analysis of Shinhan Card Point Plan card benefits (10 types)

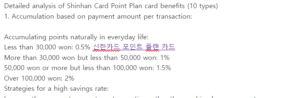

1. Accumulation based on payment amount per transaction:

Accumulating points naturally in everyday life:

Less than 30,000 won: 0.5% 신한카드 포인트 플랜 카드

More than 30,000 won but less than 50,000 won: 1%

50,000 won or more but less than 100,000 won: 1.5%

Over 100,000 won: 2%

Strategies for a high savings rate:

Increase the payment amount per transaction rather than making large payments

Accumulate points by consistently making small payments 이베이스매뉴얼

2. Domestic payment benefits:

Additional points for Shinhan SOL Pay/app payment:

Shinhan SOL Pay: +0.1%

Shinhan Card App: +0.1% (up to 10,000 points/month)

Tips for utilizing domestic payment benefits:

Develop SOL Pay/App payment habits

Take advantage of various payment options within the app

3. Overseas payment benefits:

Accumulate points when traveling overseas: 1% accumulated when using overseas affiliated stores

Foreign payment fees:

VISA/MasterCard: 1.5%

AMEX: 2.5%

Tips for utilizing overseas payment benefits:

Utilize local currency payments when traveling abroad

Use overseas travel benefit partner stores

4. Weekend dining benefits:

Points paid when paying through weekend delivery app:

Payment of 20,000 won or more per transaction: 1,000 points

Provided up to 3 times per month (total 3,000 points)

Tips for taking advantage of weekend dining benefits:

Shinhan card payment when ordering through weekend delivery app

Order with family/friends to maximize benefits

5. Regular payment automatic payment benefits:

When making automatic payments for regular payments at all domestic/overseas affiliated stores: 5,000 points paid (maximum once per month)

Tips for taking advantage of automatic payment benefits:

Set up automatic payment of regular payments such as utility bills and communication fees

Set up automatic payment for regular payments in the name of family/friends

6. Accumulate essential living expenses:

High savings when paying essential living expenses at convenience stores, supermarkets, department stores, online malls, etc.:

Convenience stores (CU, GS25, 7-Eleven): 5%

Mart (Lotte Mart, E-Mart, Home Plus): 3%

Department stores (Lotte Department Store, Shinsegae Department Store, Hyundai Department Store): 2%

Online mall (11th Street, G Market, Coupang): 1%

Tips for taking advantage of savings for essential living expenses:

Use Shinhan Card to pay essential living expenses

Check essential living expenses affiliated stores within the MySinhan app

7. Use various points:

1 point = 1 won: Can be used in various places like cash

Gift certificate/gifticon exchange: My Shinhan app or website

Mileage Exchange: Korean Air, Asiana Airlines, etc.

Others: Shopping mall discounts, cultural life benefits, etc.

8. Affordable annual fee:

Domestic only: 20,000 won/year

Overseas use: 23,000 won/year

Annual fee benefits:

Domestic/international payment accumulation rate +0.1%

Shinhan Card Membership Benefits