Terms and Conditions for Approval of the Credit Recovery Commission’s rejection of microloans 신용회복위원회 소액대출

Credit Recovery Committee microloans are products that can be received by faithfully repaying them for more than six months after undergoing debt adjustment. I have not paid the repayment for eight months, so I applied because it became a qualification requirement. Unlike other government-funded loans that are only possible by visiting the branch, it is good to apply directly on a PC or mobile.

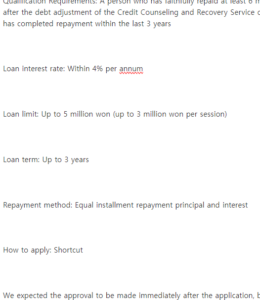

※ Credit Recovery Commission Small Loan Terms

Qualification Requirements: A person who has faithfully repaid at least 6 months after the debt adjustment of the Credit Counseling and Recovery Service or who has completed repayment within the last 3 years

Loan interest rate: Within 4% per annum

Loan limit: Up to 5 million won (up to 3 million won per session)

Loan term: Up to 3 years

Repayment method: Equal installment repayment principal and interest

How to apply: Shortcut

We expected the approval to be made immediately after the application, but the reason for rejection was unclear due to the “no” as a result of the review, so we contacted the call center of the Credit Counseling and Recovery Service (☎1600-5500). The reasons why it was not approved are as follows.

Are you thinking of taking out a Credit Recovery Commission loan? Are you worried that you will be rejected because of credit issues and debts? In fact, there are many people who cannot approve it right after applying. From now on, I will summarize 4 things and countermeasures for the cause of the Credit Recovery Commission’s rejection of microloans.

Credit Recovery Commission Denies Small Loans

The reason for the rejection was because of the recently received loan. Even if it is not overdue after the debt adjustment, it cannot be repaid because a new debt has occurred. The same applies not only to credit card microloans, but also to credit card faithfully patient loans and simple loans.

In this case, it is recommended to check the low-credit loan that suits you, not the government-supported loan. Low-credit loans in the financial sector have the advantage of high limits, making it easy to use large sums of money. Please refer to the link below.

There are other people who cannot apply. There are three types: ① delinquent, ② individual rehabilitation, and low-credit unemployed. The loans considered as alternatives are as follows.

1. a delinquent person

If delinquency information is registered in the financial history, it is difficult to borrow government-backed loans as well as bank loans. It’s just difficult, but it’s not impossible. This is because the financial sector has small products that even delinquents can receive. Please refer to TOP 8 of the delinquent unemployment loans in the link below.

2. an individual rehabilitation person

If you have been approved for individual rehabilitation, you cannot apply for a small loan from the Credit Counseling and Recovery Service. In this case, loans for individual rehabilitation and loans for individual rehabilitation are desirable. However, individual rehabilitation loans must have income and cannot be approved if the tenure is less than 3 months. Please refer to the link below.

3. a low-credit unemployed person

If you don’t have any income now and your credit rating is low, you’ll be 100% rejected. It’s considered non-repayable. In this case, it’s better to use low credit loans.

If this is also rejected, you should check your personal money, wally, and number of days. However, this product is at risk of illegal loans, so you need to be aware of the precautions before proceeding.

Credit Recovery Commission small loan

FAQ (Q&A)

Q) Review period, how long does it take to deposit money?

It takes about 3 to 7 days from approval to deposit. You can get it right after approval. However, if you receive an approval notice at the end of working hours (09:00 to 18:00), you will be deposited the next day.

Q) Do I have to pick it up in two installments?

That’s right. The total limit for small loans by the Credit Counseling & Recovery Service is 5 million won, but only up to 3 million won can be borrowed per time. The remaining 2 million won can be applied after 6 months. If you are worried about the low limit, please consider the Credit Counseling & Recovery Service’s sincere patient loan or emergency fund loans that low-credit people can use as an alternative.

Q) Don’t you have any documents to submit?

No, we don’t. Credit Recovery Commission microloans check your entire credit information through scraping techniques. You can apply right away by logging in with a joint certificate or an old public certificate.

Q) Will I be registered as a delinquent if I don’t pay?

No, small loans by the Credit Recovery Committee are not registered for arrears due to non-payment. However, if you are overdue for a long time, your credit score will drop significantly due to subrogation of Seoul Guarantee Insurance.

If you want to know low-interest products that low-credit people can receive in addition to small loans from the Credit Recovery Committee,

[Source] Credit Recovery Commission Small Loan Approval Conditions and Reviews | Author Artist